Countdown for 5.7 million customers to file their tax return

- January 6, 2024

- 12:32 pm

With less than a month to go to the Self Assessment deadline, HM Revenue and Customs (HMRC) is urging nearly 5.7 million customers to file their tax return for the 2022 to 2023 tax year.

HMRC data shows almost 6.5 million customers have already beaten the Self Assessment clock by filing their tax return including 49,317 customers who used the New Year holiday to get a head start on their tax obligations:

- 25,593 customers filed their tax return on New Years Eve, with the most popular time being between 12:00 and 12:59, when 2,677 customers filed

- 127 customers saw in the New Year by filing their tax return between 00:00 and 00:59 on 1 January

- 23,724 customers filed on New Year’s Day, with the most filing between 15:00 and 15:59, when 2,354 customers filed

The deadline to file a tax return for the 2022 to 2023 tax year and pay any tax owed is 31 January 2024. Customers can submit their tax returns and pay any tax owed online at GOV.UK.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

The clock is ticking for those customers yet to file their tax return. Don’t put it off, kick start the new year by sorting your Self Assessment. Go to GOV.UK and search ‘Self Assessment’ to get started start today.

HMRC has a wide range of resources online including a series of video tutorials on YouTube, help and support on GOV.UK, to support customers in completing their tax return.

The quickest and easiest way customers can pay their tax bill is via HMRC’s app which is free and secure. Information about the different ways to pay can be found on GOV.UK.

Customers who are unable to pay in full can access support and advice on GOV.UK. HMRC may be able to help by arranging an affordable payment plan, known as Time to Pay for those who owe less than £30,000. Customers can arrange this themselves online. Go to GOV.UK and search “HMRC payment plan” for more information.

HMRC will consider a customer’s reasons for not being able to meet the deadline. Those who provide HMRC with a reasonable excuse may avoid a penalty. The penalties for late tax returns are:

- an initial £100 fixed penalty, which applies even if there is no tax to pay, or if the tax due is paid on time

- after 3 months, additional daily penalties of £10 per day, up to a maximum of £900

- after 6 months, a further penalty of 5% of the tax due or £300, whichever is greater

- after 12 months, another 5% or £300 charge, whichever is greater

There are also additional penalties for paying late of 5% of the tax unpaid at 30 days, 6 months and 12 months. Interest will also be charged on any tax paid late.

Customers need to be aware of the risk of falling victim to scams and should never share their HMRC login details with anyone, including a tax agent, if they have one. HMRC scams advice is available on GOV.UK.

Further information

Find out more about Self Assessment.

During January, we’re supporting customers who have queries about Self Assessment payments, refunds and who need help completing their tax return on our helpline. For all other queries go online where you’ll find guidance, videos and tools that will help you. Go to GOV.UK and search ‘Self Assessment’.

HMRC wants to help you get your tax right. Lots of information and support is available online which includes:

- HMRC’s digital assistant – the assistant will help you find information, and if you can’t what you’re looking for you can ask to speak to an adviser

- guidance notes and help sheets and YouTube videos provide a wealth of information if you’re stuck or confused

- live webinars where you can ask questions or if you can’t join, you can watch recorded webinars on demand

- HMRC app and Personal Tax Account – you can instantly find your Unique Taxpayer Reference, make a Self Assessment payment, get your National Insurance number and get your employment income and history for your tax return

- technical support for HMRC online services for help signing into online services

- email updates – subscribe to HMRC email updates so you don’t miss out on the latest information on Self Assessment

- social media updates – follow HMRC Twitter @HMRCcustomers to get the latest updates on Self Assessment services and useful reminders

- if you need extra support to help your with Self Assessment you can contact a voluntary or community sector organisation who can provide you with help and advice, or you can get support directly from HMRC

The small minority of customers who require extra support or struggle to engage with us digitally can still speak to an adviser.

If you think you are no longer required to complete an Self Assessment return, you can check if you need to send a Self Assessment tax return.

Customers should include their bank account details when filing, so that if HMRC needs to make a repayment, they can do so quickly and securely.

It is important that customers let HMRC know of any changes to their circumstances. Customers can use the HMRC app to update their details including a new address or name. Customers also need to let us know if they’ve stopped being self-employed or need to change their business details. This can be done online at GOV.UK.

From 1 January 2024, online selling platforms are required to collect and report seller information and income to HMRC. These digital platforms must report sellers’ income by January 2025. You can read more information on GOV.UK.

Other news

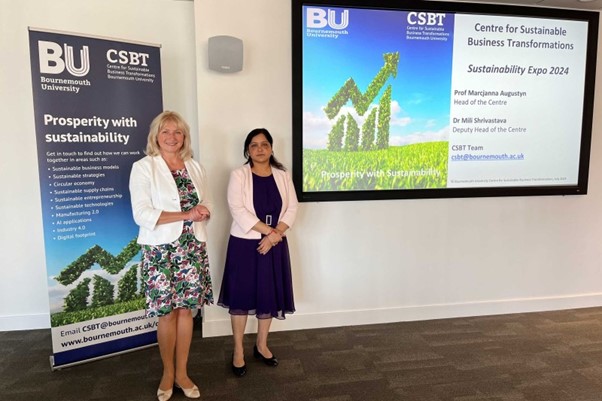

Annual Sustainability Expo at Bournemouth University inspires collaboration

BU’s Centre for Sustainable Business Transformations (CSBT) has hosted its annual Sustainability Expo, bringing businesses and academics together for an afternoon of discussions and networking.

Applications are now open to run for Team YMCA in the TCS London Marathon 2025

This year, the YMCA will not be allocating places on a first come first served basis. Instead, applications will be reviewed based on quality

Book your stand for the Business Festival Expo

Dorset Chamber’s next Business Expo takes place on 2 October during the Dorset Business Festival and bookings are now open for this leading B2B event featuring 60+ businesses.

FinTech West launches new funding initiatives to support startup growth on the South Coast

Two new funding initiatives have been announced by FinTech West’s South Coast Hub for FinTech startups based in the region which aim to bring together potential investors with the next generation of FinTech entrepreneurs from Bournemouth, Christchurch, Poole and the surrounding area.

YMCA Bournemouth grows its support to businesses and charities by launching a Clinical Supervision service

Clinical supervision is a formal process of professional support, reflection and learning that contributes to individual development.

It consists of the practitioner meeting regularly with another professional, not necessarily more senior, but normally with training in the skills of supervision, to discuss casework and other professional issues in a structured way.

Business Leaders Gather for Insightful Sustainability Reporting Masterclass

Local organisations joined the Bournemouth University Business School’s Centre for Sustainable Business Transformations (CSBT) for their latest event,